Compliance Corner

The latest federal and state legislative updates are now available on our blog:

- Federal: FAQ about Employee Retention Credit

- Federal: IRS announcement for Roth catch-up requirement and contributions

- Federal: FUTA Tax Credit Reduction

- California: Proposal of Earned Wage Access (EWA) Regulations

- Delaware: Extension of Temporary Relief

- Hawaii: Job Listing Requirement

- Illinois: Paid Leave and Freelance Worker Protection Act

- Illinois: Veterans Day Paid Leave Act and Pay Scale Disclosure

- Oregon: OregonSaves Retirement Plan

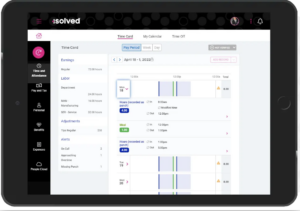

How Tracking Time Can Save Your Business

Did you know that failing to track employee time can cost your business a lot of extra money? Here are a couple of ways it can wreak havoc on your budget:

- Inaccurate time data: Even a few extra minutes added to a timecard can add up. If you have 10 employees who each add 20 extra minutes per day, that adds up to 1,000 extra minutes per week (or almost 17 hours). At $15 per hour, you’re looking at over $250 in overpayment every week.

- Unplanned overtime: If employees don’t realize they’re going into overtime, your company could end up paying more than expected at the end of the pay period. With a tracking solution in place, managers can set up alerts to know who is approaching overtime and plan accordingly, eliminating the cost of unplanned overtime.

These are just two examples – you could also end up facing costly compliance penalties if your company can’t produce accurate time records. Protect yourself and your bottom line with a timekeeping solution built for your business needs.

Check out the time and labor solutions we deliver to clients to see what works for your business. All data flows through the HR and payroll system, ensuring accurate paychecks and records to keep your company in compliance.

Self-Service Portal

Did you know the HCM solution we provide to clients includes an employee self-service portal at no additional charge? Today’s employees aren’t tied to their desks, and they should have access to their information from anywhere. The self-service portal makes it easy to stay connected, and it’s available from anywhere at any time. Click here to learn more!

Important: We Need to Know of Any Changes

If your business makes any changes to its name, employer identification number (EIN), or bank account information, we need to know right away. Please inform us immediately of these changes to avoid processing delays and other issues.